Introduction to Recurring Business Revenue Models

What is the Recurring Revenue Model?

Recurring revenue is a consistent stream of income generated from customers over time, crucial for businesses aiming for long-term success.

A recurring revenue model is a business strategy focusing on generating consistent, predictable customer revenue at regular intervals. This model is contrasted with one-time transactions or sales.

It's popular across various industries, especially in services, subscriptions, and software-as-a-service (SaaS) companies.

Here are some key characteristics

Characteristics:

- Predictable Income: It provides businesses with a more predictable income stream, making financial planning and budgeting more efficient.

- Customer Retention: Emphasizes long-term customer relationships, as revenue is tied to customer retention over time.

- Subscription-Based Pricing: Often involves subscription-based pricing, where customers pay a regular fee (monthly, annually, etc.) to access a product or service.

- Diverse Payment Plans: Can include various payment plans to suit different customer needs, enhancing the potential for upselling and cross-selling.

- Lower Upfront Cost: For customers, the model often presents a lower upfront cost compared to purchasing a product or service outright, which can lower the barrier to entry.

Recurring Revenue vs. Non-Recurring Revenue: Understanding the Impact on Cash Flow

Types of Recurring Revenue Models that Work

Recurring revenue models have evolved to fit various business needs and customer preferences.

By examining them through the lens of predetermined service charges, recurring purchases, automatic renewals, and usage-based billing, we can gain deeper insights into their effectiveness and applications.

Fixed Service Charges

This model involves charging customers a set fee for access to services or products over a specific period. It's favored for its simplicity and predictability, both for the business and the customer.

- Customers agree to pay a fixed amount regularly (monthly, quarterly, or annually), which grants them access to a service or a bundle of products.

- The value offered must clearly outweigh the cost. Providing exceptional service and regular updates or enhancements can justify the ongoing expense to customers.

Real-World Application: Gym memberships and software-as-a-service (SaaS) platforms like Salesforce operate on this model, offering continuous access to their services for a fixed fee.

Recurring Purchases for Continuous Access

This model is built on the premise of customers making regular purchases to maintain access to a product or service. It's particularly effective when the product or service is essential or integrates seamlessly into daily routines.

- Unlike one-time purchases, this approach encourages ongoing buying behavior, often facilitated by subscription services or consumable goods that need regular replenishment.

- Ensuring product quality and necessity are crucial. The purchasing process must be hassle-free, possibly automated, to encourage repeat transactions.

Real-World Application: Amazon's Subscribe & Save offers a recurring delivery service for consumable products, simplifying the replenishment process and ensuring continuous use without interruption.

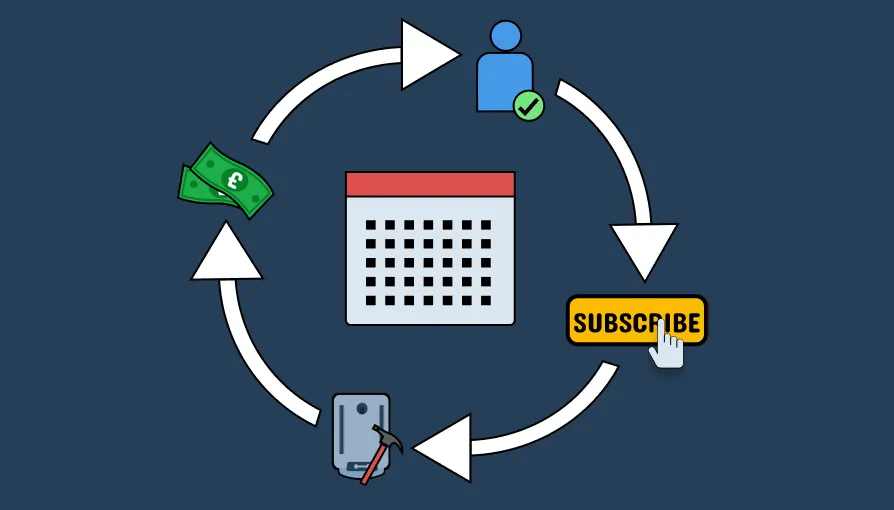

Automatic Subscription Renewals

Automatic renewals remove the friction from the decision-making process, keeping the subscription active until the customer decides to cancel. This model boosts retention and ensures a more stable revenue stream.

- Subscriptions are automatically renewed at the end of each payment cycle, with charges applied to the customer’s preferred payment method.

- Transparency and ease of cancellation are paramount to maintain trust and satisfaction. Providing timely reminders before renewal can also enhance customer relationships.

Real-World Application: Streaming services like Netflix and software subscriptions like Microsoft Office 365 utilize automatic renewals to maintain their subscriber base, emphasizing convenience and uninterrupted service.

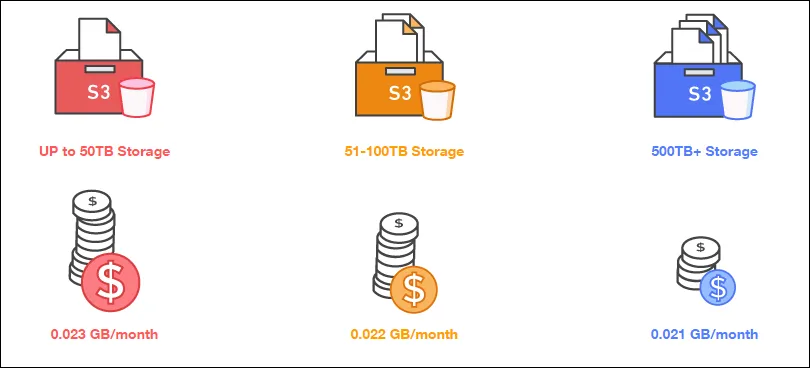

Usage-Based Billing

Tailoring charges to actual usage aligns costs with value received, appealing to customers who prefer paying only for what they consume. This model offers flexibility and can adapt to varying customer needs.

- Billing is based on the volume of services or products used within a billing period. This can range from data consumption on a mobile plan to the number of API calls made to a cloud service.

- Implementing a transparent and accurate tracking system ensures customers are billed fairly, enhancing trust and satisfaction. Clear communication about pricing tiers and usage thresholds is also essential.

Real-World Application: Utility companies have long used this model for water and electricity consumption. In the digital age, cloud providers like Amazon Web Services (AWS) offer pay-as-you-go pricing models for cloud resources, ensuring customers pay in proportion to their usage.

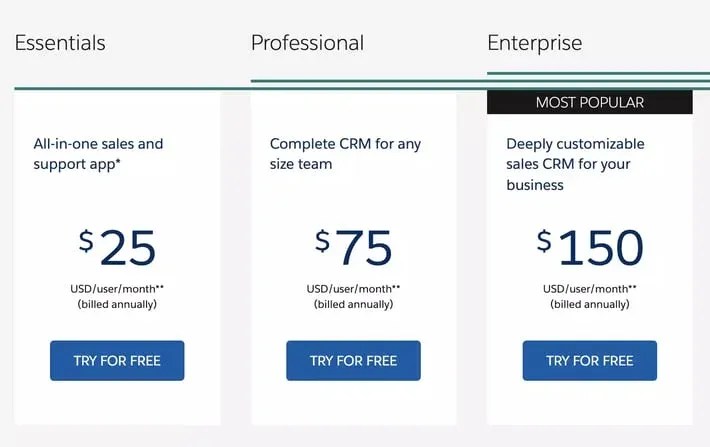

Tiered Pricing Strategy

Multiple tiers in the pricing structure enable businesses to offer packages with varying levels of features and services, catering to different customer segments.

- Customers can choose from several tiers, usually labeled as Basic, Standard, Premium, etc., each with its own set of features and price points.

- Clearly defined tiers and transparent communication about the benefits of each level encourage customers to select the tier that best fits their needs, potentially upselling themselves over time.

Real-World Application: Software companies often use tiered pricing to differentiate their offerings. Adobe Creative Cloud, for example, offers different packages tailored to photographers, designers, and other creative professionals.

Hybrid Billing Models

Combining recurring and one-time billing models allows businesses to offer core services on a subscription basis while charging separately for one-off services or products.

- The foundational service is provided for a recurring fee, with additional features, products, or services available for one-time charges as needed.

- Balancing the core value offered through the subscription with the appeal of one-off purchases that enhance the user experience is essential.

Real-World Application: Many SaaS platforms use this model, offering a base subscription for core services while charging extra for premium features, integrations, or additional storage.

Free Access with Basic Plans

Offering free lifetime access to a basic version of a product or service can attract users by lowering the entry barrier, with the aim of converting them to paid versions for more advanced features.

- Users sign up without any initial cost, gaining access to fundamental features. The business then monetizes these users by encouraging upgrades to paid plans.

- The free plan must offer enough value to attract users, but the paid plans should significantly enhance that value to motivate upgrades.

Real-World Application: Many digital platforms start with a free basic plan, like Trello for project management, which offers additional features, more integrations, and greater capacity in its paid tiers.

Ideas to Make the Recurring Revenue Business Model Work

The shift towards a recurring revenue model offers businesses a beacon of stability and predictable financial growth. This model not only assures a steady stream of income but also deepens client relationships by providing continuous value.

Content-Driven Strategy

Leveraging content for recurring revenue involves creating and monetizing valuable resources that your clients seek.

- Ebooks and Online Courses: Identify topics of interest or areas where your expertise can address client needs. Develop ebooks or online courses that offer actionable insights, catering to those interests.

- Social Media Templates: Offer customizable templates for platforms like Instagram, assisting clients in enhancing their digital presence with minimal effort.

- Membership Sites: Combine various content forms into an exclusive membership site. Charge a monthly fee for access to unique, value-adding content not available elsewhere. Highlight the exclusive benefits and unique insights members receive, positioning your content as indispensable.

Service-Based Strategy

Services, especially software as a service (SaaS), present lucrative opportunities for generating recurring revenue, given their potential for long-term profitability.

- Develop a SaaS Product: Identify a gap in your industry that software could fill. If software development isn't your forte, consider partnering with a developer. Focus on tools that simplify tasks for your clients, such as marketing automation or project management solutions.

- Maintenance and Hosting Bundles: For web agencies, offering website maintenance and hosting services on a subscription basis can ensure ongoing engagement. Create tiered service packages to cater to diverse client needs, and consider reselling hosting as part of a comprehensive maintenance bundle.

- Partner with Cloud Service Providers: Programs like the Cloudways Agency Partnership offer additional perks like discounts and premium support, enhancing the value you provide to your clients and solidifying your recurring revenue streams.

Product-Based Strategy

Physical or digital products can also be structured to generate recurring income, adding a tangible element to your revenue model.

- Subscription-Based Design Services: Follow the model of services like Design Pickle to offer unlimited design services for a fixed monthly fee. This provides predictable costs for clients while ensuring steady income for your agency.

- Themes and Plugins: Develop and sell premium themes and plugins with a subscription model for updates and support. This not only ensures that clients have access to the latest features but also builds a recurring income source.

How to Build Your Recurring Revenue Business Model

Transitioning from a traditional one-off sales model to a recurring income framework represents a strategic pivot that can unlock sustainable growth and build a more predictable revenue stream for your business.

This shift involves not just altering how you charge your customers, but also rethinking product delivery, customer relationship management, and revenue forecasting.

Understanding the Shift

Why Make the Transition?

- Predictable Revenue: Recurring revenue models, like subscriptions or memberships, offer predictable monthly or annual income, facilitating better financial planning and stability.

- Enhanced Customer Value: By focusing on long-term relationships, you can continuously deliver value, improving customer satisfaction and retention.

- Scalability: Recurring models often allow for easier scaling of your business operations and customer base without proportionately increasing your sales efforts.

Steps to Transition to a Recurring Revenue Model

1. Evaluate Your Offerings

- Assess which products or services can be naturally offered on a recurring basis. Consider how your current offerings can be repackaged or expanded to fit a subscription model, membership program, or usage-based billing system.

2. Define Your Value Proposition

- Clearly articulate the ongoing value your customers will receive from subscribing to your service. This could be in the form of continuous access to products, exclusive content, or regular service updates.

3. Develop a Pricing Strategy

- Create Tiered Options: Offer different levels of service or product access at varying price points to cater to a broad customer base.

- Consider Usage-Based Models: For some businesses, charging based on usage can be more appealing to customers than a flat-rate subscription.

4. Set Up the Necessary Infrastructure

- Invest in or upgrade to systems that can handle recurring payments, subscription management, and customer service for subscribers. Automation tools for billing and renewals can significantly reduce administrative overhead.

5. Revise Your Sales and Marketing Approach

- Shift your marketing strategy to highlight the benefits of ongoing relationships and the value of continuous service. Use case studies and testimonials to show potential customers the long-term benefits of switching to a subscription.

6. Focus on Customer Success and Retention

- Implement programs designed to onboard customers effectively, helping them see the value of their subscription from day one.

- Regularly collect and act on customer feedback to improve your service and keep your offerings aligned with customer needs.

7. Monitor and Adapt Your Model

- Keep a close eye on key metrics such as churn rate, lifetime value (LTV), and customer acquisition cost (CAC) to understand the health of your recurring revenue model.

- Be prepared to iterate on your offerings, pricing, and customer engagement strategies based on performance data and customer feedback.

Example framework for setting up a recurring revenue model for a hypothetical business

One-Off Sales to Recurring Income for the Business: Cloud-Based CRM Software for Small Businesses

Step 1: Define Your Offering

- Core Product: A cloud-based Customer Relationship Management (CRM) software designed for small businesses.

- Value Proposition: Helps small businesses manage their sales, marketing, and customer service efforts more efficiently, all in one place.

Step 2: Determine Pricing Tiers

- Basic Tier: $10/month for up to 2 users, with essential CRM features.

- Professional Tier: $25/month for up to 10 users, includes advanced analytics, marketing tools, and customer support.

- Enterprise Tier: Custom pricing for unlimited users, with premium features including custom integrations, dedicated account manager, and onboarding support.

Step 3: Set Up Payment Structure

- Subscription Basis: Monthly and annual payment options, with a discount for annual commitments.

- Free Trial: Offer a 14-day free trial for the Professional Tier to attract new customers and allow them to experience the software's capabilities.

Step 4: Customer Engagement and Retention Plan

- Onboarding Process: Provide a guided onboarding experience for new customers, including video tutorials and live webinars.

- Customer Support: Offer 24/7 customer support through chat, email, and phone.

- Feedback Loop: Regularly collect customer feedback to improve the product and introduce new features based on user demand.

Step 5: Marketing and Growth Strategies

- Content Marketing: Publish articles, case studies, and videos that demonstrate the value of your CRM software for small businesses.

- Referral Program: Implement a referral program that rewards existing customers for bringing in new subscribers.

- Partnerships: Form partnerships with other software providers that offer complementary services to your target market.

Step 6: Financial Projections and Metrics

- Break-even Analysis: Calculate the number of subscribers needed at each tier to cover your costs and reach profitability.

- Churn Rate: Monitor the churn rate closely, as it's a critical metric for subscription-based businesses. Implement strategies to minimize churn, such as periodic feature updates, excellent customer service, and targeted customer re-engagement campaigns.

- Lifetime Value (LTV): Calculate the LTV of a customer to understand how much you can afford to spend on acquisition while still making a profit.

Implementation

Implementing this model requires a robust billing system that can handle recurring payments and manage subscriptions. Additionally, investing in customer relationship management and analytics tools will help you understand customer behavior, improve the product, and personalize marketing efforts.

How Recurring Revenue Models Propel Businesses Forward

Recurring revenue models have reshaped the landscape of business growth and sustainability, offering a blueprint for continuous income and customer engagement.

By shifting the focus from one-time transactions to ongoing relationships, businesses can unlock a myriad of benefits that fuel long-term success.

Here's an in-depth look at how these models drive businesses forward:

Financial Stability and Predictability

Recurring revenue model provide businesses with a consistent and predictable revenue stream. This predictability is crucial for strategic planning and investment.

Predictable Monthly Revenue

With a recurring revenue model, companies can forecast monthly revenue with greater accuracy.

For example, Adobe reported a jump in its predictable revenue, with a 24% year-over-year increase in its Digital Media segment, largely attributed to its subscription services.

Lower Financial Volatility

The consistency of a recurring revenue stream means businesses face less volatility and uncertainty. This stability is essential for budgeting, planning, and securing investments.

Enhanced Customer Retention

Recurring revenue models thrive on long-term customer relationships. By continuously delivering value, businesses can significantly improve retention rates.

Building Loyalty

Continuous engagement helps in building a loyal customer base. For instance, Netflix's focus on constantly updating its content library has helped maintain a subscriber churn rate that is remarkably low for the industry, reportedly below 10%.

Increased Customer Lifetime Value (CLV)

The longer a customer stays subscribed, the higher their lifetime value. Salesforce, a leader in CRM solutions, has seen its CLV increase due to its subscription model, contributing to the company's growth and profitability.

Streamlining Operations

The efficiency of operations is greatly enhanced under a recurring revenue model, as it allows businesses to optimize resource allocation and reduce costs associated with customer acquisition.

Operational Efficiencies

Automating billing and subscription management reduces administrative costs and improves the customer experience.

Cost-Effective Marketing and Sales

Acquiring a new customer is more expensive than retaining an existing one. Subscription models generate recurring revenue from the same customer base, reducing the need for constant outreach and new customer acquisition efforts.

Driving Innovation and Improvement

The ongoing nature of the customer-business relationship in a recurring revenue model fosters an environment ripe for innovation and continuous improvement.

Feedback Loop

Regular interaction with customers provides valuable feedback that can be used to refine and improve offerings. Spotify’s algorithmic playlists, for example, are continually refined based on user listening habits, enhancing user satisfaction and retention.

Adaptability

The model's flexibility allows businesses to quickly adapt to market changes or customer needs, ensuring the product or service remains relevant and valuable.

Competitive Edge

Adopting a recurring revenue model not only secures a steady income but also provides a competitive edge in the marketplace.

Market Differentiation

Offering subscriptions or memberships can set a company apart from competitors who rely on one-time sales.

Customer Acquisition

A compelling recurring revenue offer can be a powerful tool in attracting new customers. For example, Microsoft’s Office 365 has successfully leveraged its subscription model to dominate the productivity software market, transitioning many users from one-time software purchases to ongoing subscriptions.

How to Measure Success in Recurring Revenue Business Models

Given the emphasis on long-term customer relationships and continuous revenue streams, businesses must adopt specific key performance indicators (KPIs) to accurately assess the health and viability of their recurring revenue models. Here’s an in-depth look at the essential metrics and approaches to measuring success in these business models

1. Monthly Recurring Revenue (MRR)

MRR is the total predictable revenue generated by your business from all the active subscriptions in a month. It's a vital metric for understanding the month-to-month health of a subscription-based business.

- How to Calculate: Sum up the recurring charges of all active subscriptions within the month.

2. Annual Recurring Revenue (ARR)

ARR is similar to MRR but projected over a year. It's particularly useful for businesses with subscriptions that have annual payment cycles.

- How to Calculate: Multiply your MRR by 12, or sum up the recurring charges of all active annual subscriptions.

3. Customer Lifetime Value (CLV)

CLV represents the total revenue a business can expect from a single customer account throughout their business relationship. It helps businesses understand how much they should be willing to spend to acquire a customer.

- How to Calculate: Multiply the average purchase value by the number of transactions and the retention time period.

4. Customer Acquisition Cost (CAC)

CAC is the total cost of acquiring a new customer, including all aspects of marketing and sales divided by the number of new customers acquired.

- How to Calculate: Divide total marketing and sales expenses by the number of new customers acquired over the same period.

5. Churn Rate

The churn rate indicates the percentage of customers or subscribers who cancel or do not renew their subscriptions during a given time period. It's critical for assessing customer retention and satisfaction.

- How to Calculate: Divide the number of customers lost during the period by the total number of customers at the beginning of the period.

6. Expansion Revenue

This metric tracks revenue growth from existing customers through upsells, cross-sells, and add-ons. It's an important growth lever for recurring revenue businesses.

- How to Calculate: Sum the additional revenue earned from existing customers through upselling or cross-selling efforts over a period.

7. Revenue Churn Rate

Revenue churn rate measures the percentage of recurring revenue lost from existing customers due to cancellations or downgrades in a given period.

- How to Calculate: Divide the lost recurring revenue (excluding revenue from new customers) by the total recurring revenue at the start of the period.

8. Net Revenue Retention (NRR)

NRR indicates the percentage of recurring revenue retained from existing customers over a period, including expansions and contractions but excluding new customer revenue.

- How to Calculate: Subtract revenue churn and contractions from the total revenue at the start of the period, add expansion revenue, and then divide by the total revenue at the start of the period.

9. Gross Margin

Gross margin measures the difference between revenue and the cost of goods sold (COGS), expressed as a percentage of revenue. It's essential for understanding the profitability of the products or services sold.

- How to Calculate: Subtract COGS from total revenue, divide by total revenue, and then multiply by 100.

Example of How to Measure Success of Recurring Revenue Model

Let's consider a hypothetical Software as a Service (SaaS) company, "SaaSPro," to illustrate how to calculate the key metrics involved in measuring the success of a recurring revenue model. We'll walk through the calculations of Monthly Recurring Revenue (MRR), Annual Recurring Revenue (ARR), Customer Lifetime Value (CLV), Customer Acquisition Cost (CAC), Churn Rate, and Expansion Revenue.

Background Information

- Starting Customers: 100

- New Customers in Month: 20

- Lost Customers in Month: 5

- Average Subscription Fee: $100/month

- Marketing and Sales Expenses for Month: $5,000

- Average Customer Lifespan: 3 years

- Revenue from Upsells in Month: $2,000

1. Monthly Recurring Revenue (MRR)

MRR is calculated by multiplying the total number of paying customers by the average revenue per user (ARPU).

MRR=Total Customers × Average Subscription Fee

MRR= (100+20−5)×100 = 115×100 = $11,500

2. Annual Recurring Revenue (ARR)

ARR is the MRR multiplied by 12.

ARR= MRR×12

ARR= $11,500×12 = $138,000

3. Customer Lifetime Value (CLV)

CLV is calculated by multiplying the average revenue per user per month by the average customer lifespan (in months).

CLV= ARPU×(Customer Lifespan in Months)

CLV=$100×(3×12)=$100×36=$3,600

4. Customer Acquisition Cost (CAC)

CAC is the total marketing and sales expenses divided by the number of new customers acquired.

CAC= (Total Marketing and Sales Expenses) / (New Customers)

CAC=$5,000/20=$250

5. Churn Rate

The churn rate is the number of lost customers divided by the total customers at the start of the period, multiplied by 100 to get a percentage.

Churn Rate=(Lost Customers/Total Starting Customers)×100

Churn Rate=(5/100)×100=5%Churn Rate=(1005)×100=5%

6. Expansion Revenue

Expansion revenue is additional revenue generated from existing customers through upsells or service upgrades within the period. In this case, it's given as $2,000.

7. Revenue Churn Rate

The Revenue Churn Rate measures the percentage of revenue lost from existing customers. Assuming the 5 lost customers were paying the average subscription fee:

Lost Revenue=Lost Customers × Average Subscription Fee

Lost Revenue=5×100=$500

Revenue Churn Rate=(Lost Revenue/Starting MRR)×100

Revenue Churn Rate=(500/11,500)×100≈4.35%

Net Revenue Retention (NRR)

NRR measures the percentage of recurring revenue retained from existing customers, factoring in expansion revenue and churn.

NRR=(Starting MRR−Lost Revenue + Expansion Revenue/Starting MRR)×100

NRR=(11,500−500+2,000/11,500)×100

NRR=(13,000/11,500)×100≈113.04%

Gross Margin

Gross Margin is calculated by subtracting the Cost of Goods Sold (COGS) from the revenue and dividing by the total revenue, then multiplying by 100 to get a percentage.

Gross Margin=(MRR−COGS/MRR)×100

Gross Margin=(11,500−4,500/11,500)×100

Gross Margin=(7,000/11,500)×100≈60.87%

Interpretation

- MRR and ARR indicate SaaSPro's current and projected annual income from subscriptions, showing growth potential.

- CLV suggests the total revenue SaaSPro can expect from an average customer over their relationship, highlighting the importance of customer retention.

- CAC reveals the cost to acquire each new customer, which, when compared to CLV, suggests profitability.

- Churn Rate at 5% shows SaaSPro is retaining most of its customer base, but there's always room for improvement to reduce churn further.

- Expansion Revenue shows SaaSPro is successfully upselling to its existing customer base, adding to its recurring revenue without the need for new customer acquisition.

- Revenue Churn Rate: Approximately 4.35%

- Net Revenue Retention (NRR): Approximately 113.04%, indicating growth in revenue from existing customers despite churn.

- Gross Margin: Approximately 60.87%, suggesting that after direct costs are covered, 60.87% of the revenue is profit before operating expenses, taxes, interest, and other expenses.

Overcoming Common Obstacles in Implementing Recurring Revenue Models

1. Customer Resistance to Subscription Business Models

Some customers may prefer owning a product outright rather than paying ongoing fees, perceiving subscriptions as a commitment they're not ready to make.

- Educate on Value: Highlight the continuous value and benefits provided through the subscription, such as regular updates, enhanced features, and support services.

- Offer Flexible Terms: Reduce perceived risk by offering trial periods, easy cancellation policies, and money-back guarantees.

2. Adjusting Internal Processes

Shifting to a recurring revenue model often requires significant changes in billing, sales, customer service, and overall operational workflows.

- Invest in Technology: Utilize subscription management software and CRM systems that automate billing, manage subscriptions, and track customer interactions efficiently.

- Train Your Team: Educate your sales and customer service teams on the nuances of selling and supporting subscription products.

3. Pricing Strategy Complexities

Determining the right price for a subscription service can be challenging, as it needs to reflect the value provided while remaining attractive to customers.

- Market Research: Conduct thorough research to understand what customers are willing to pay and how competitors are pricing similar offerings.

- Tiered Pricing Models: Introduce multiple pricing tiers to cater to different customer segments, providing options that range from basic to premium services.

4. Managing Customer Churn

Customer churn, where subscribers cancel their subscriptions, directly impacts the revenue stream and growth prospects of the business.

- Monitor Churn Reasons: Regularly analyze why customers are leaving and address these issues directly, whether it's through product improvements, better customer support, or more engaging content.

- Engage Proactively: Implement strategies for customer engagement and satisfaction, such as personalized communications, loyalty programs, and regular feedback loops.

5. Ensuring Continuous Value Delivery

The success of a recurring revenue model hinges on the continuous delivery of value that justifies the ongoing cost to the customer.

- Frequent Updates and Innovations: Continuously enhance your product or service with new features, content, or improvements that keep the offering fresh and valuable.

- Customer Success Focus: Develop a customer success team dedicated to helping customers derive maximum value from your product or service, thereby increasing satisfaction and reducing churn.

6. Regulatory and Compliance Issues

Subscription services, especially those that handle customer data or operate across borders, can face complex regulatory challenges.

- Stay Informed: Keep abreast of relevant regulations, such as data protection laws, and ensure your business practices comply.

- Transparent Policies: Clearly communicate your terms of service, privacy policy, and subscription terms to build trust and avoid legal pitfalls.

.jpg)

.jpg)